When a transaction is processed through the Opayo system, the details of that individual payment are passed through to Opayo’s fraud screening service for analysis to be carried out. Using adaptive behavioural analytics to spot and block fraud our solution continually improves and adapts to new risks.

Opayo’s fraud screening tool will take all of the information that has been captured and use this information to build a risk score that will be available to you in real time. Once the transaction information has been passed to Opayo’s fraud screening systems for analysis against a fraud and risk rule set, a risk score will be produced calculating the likelihood of the transaction being legitimate or fraudulent.

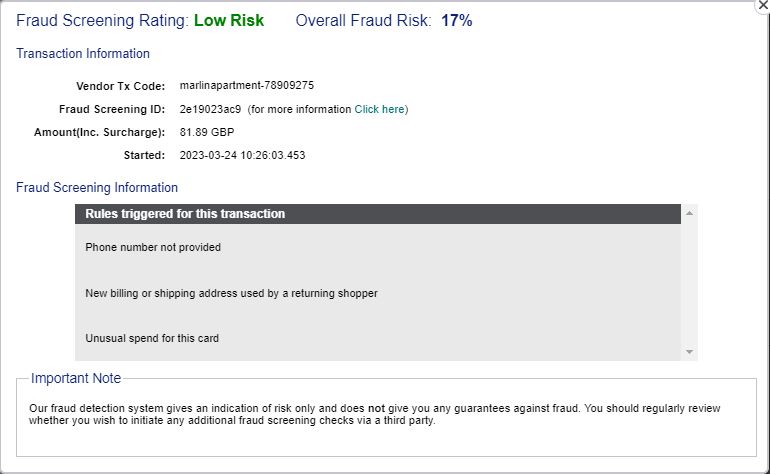

All transactions begin with a score of 0 when the transaction is first submitted to fraud screening for analysis. Each rule that is triggered increases the percentage risk of the transaction. Should the risk level exceed an acceptable threshold an advisory alert appears in MyOpayo.

Once the risk score has been assigned, the score will then be available in the MyOpayo portal and via our API. We provide the score as well as a summary of the rules the transaction triggered.

Customer Service

Elavon Customer Service:

0818 20 21 20

Opayo Product Support:

01 240 8731

Search our help centre

Fraud screening explained

When processing any type of transaction you always need to be aware of the potential risks of fraud, and what you can do to prevent it. Fraud screening provides all of your transactions with a score and rating that highlights the level of risk the transaction pose to your business.

When a transaction is reviewed by the fraud screening system it uses the information submitted with the transaction to build a score. We look at each piece of submitted information individually and it is ran against a set of rules.

The transaction will then provide you with a score, and a risk level that you can breakdown to see the impact each indicator has had on the transaction.

What is a fraud indicator?

A fraud indicator is simply a part of the transaction that is used to build the score. The most common fraud indicators along with a very brief description for any transactions are:

Email address

The fraud screening system uses the structure of the email address as part of the scoring.

- Is the name in the email address

- What type of email domain is being used - Yahoo, Gmail, etc

IP address

The IP address and location are used as part of the scoring.

- Is it a domestic IP address?

- Does it originate from a high risk country?

Telephone number

Although not critical to the scoring the telephone can impact the overall score for the transaction.

- Has the telephone number been provided?

- Is the telephone number a landline?

Billing & delivery address

Using the addresses either together or separately can contribute to the score.

- Are the billing & delivery addresses different?

- Has there been recent high spends at the addresses?

Fraud prevention checks

The results of address, postcode, security key, and 3-D Secure checks are used to build the score.

- Have the address and postcode values matched the card used for the transaction?

- Has the customer passed 3-D Secure verification?

Card details

The card, type, and frequency are all used to form the score for the transaction.

- How often has the card been used?

- How many different cards have been used?

Historical information

How often the elements of the transaction have been seen previously - and if they have been seen together.

- Have the elements been seen together before?

- How long ago have they been seen together?

Transaction value

The transaction value is important to the scoring -

- Is the transaction a high value?

- Is the transaction low value?

Important

These are not all of the rules and triggers that are assigned to each of the fraud indicators. For a full break down of the rules assigned to each indicator download the the fraud screening guide. You will then see each rule that is applied to every indicator on the system.

These are not all of the rules and triggers that are assigned to each of the fraud indicators. For a full break down of the rules assigned to each indicator download the the fraud screening guide. You will then see each rule that is applied to every indicator on the system.

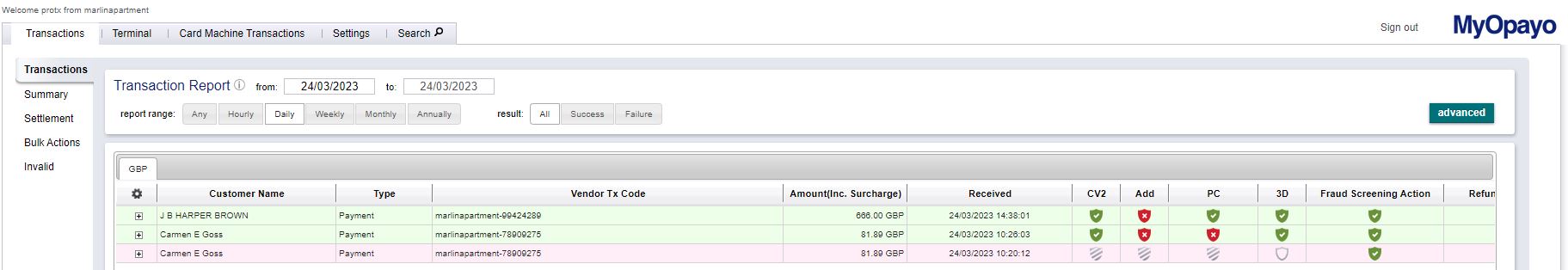

- Once logged into MyOpayo you will need to go to the transactions tab. You will then see your transaction list along with the fraud screening rating.

2. To view the scoring breakdown further you will need to click on the individual transaction followed by fraud results tab.

3. Once on this screen you will see the fraud screening results at the bottom of the page – you will see both a score and a rating.

4. Click on the rating and this will open the full breakdown on the screen for you.

You can then see all of the rules that have been triggered for the account and you will then be able to make a decision on the transaction and what is best for your business.

Once a transaction has been processed through your account and passed through to Featurespace for review the details of the transaction are then validated and checked by Featurespace.

Featurespace checks all available information for each transaction, including Personal, Payment, and Address information.

They then screen this information to identify any suspicious behaviour or where there is high risk.

Some of the parameters that are screened are:

- Multiple addresses used by the same person or card.

- Repetitive names or addresses used.

- Similar names or addresses used.

- Repetitive card attempts.

- Delivery to 3rd party or high-risk postal areas, etc.

Alongside the above information Featurespace also check over 100 different variables to provide you with a score, and a rating for each transaction.

As well as validating the details the shopper has provided Featurespace system also looks at a number of other parameters to build score:

- Who is making the transaction?

- What are they buying?

- Where is it to be delivered?

- When was it ordered and when will it be delivered?

The information that is validated by Featurespace is solely based on details provided with the transaction. If any of the shopper’s information differs from the details they have provided with the transaction the score will not be valid.

The scores that are provided to you are based exclusively on the information that is submitted with the transaction. Details of the e-mail, delivery address, phone numbers, and IP addresses must be provided wherever possible.

Please remember that the more transactional information you provide, the more accurate the risk score will be.

The fraud screening platform offers your business a number of benefits:

- Helps to avoid fraud and chargebacks – By using the Fraud Screening scoring system you will be able to identify transactions that are highlighted as risks and take steps to prevent fraud on your account.

- The Fraud Screening system provides you with more information about the person making the purchase and lets you identify fraud before it takes place.

- No integration and Easy to use – Fraud Screening is available to you as soon as your account is Live within MySagePay. There is no integration that you need to take in order to have this on your account.

- Informative – The detailed risk analysis will provide you with the reasons why a transaction was given a particular fraud score. This will aid your decision making on whether or not you wish to accept or reject a transaction.